Continued from:Strategically dangerous: What Makes or Breaks CEOs ( III )

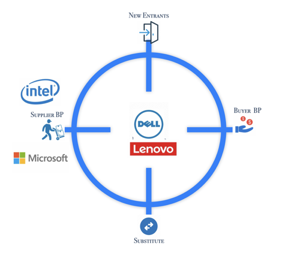

However, the fact remains that within a given industry, the relative strength of the five forces and their specific configuration determine the industry’s profit potential because they directly impact the industry’s prices and its costs. The way they impact the industry profitability in a predictable way.

Any successful company has positioned itself favorably in relation to the forces that matter most in its industry. When doing strategic planning (the real one), this approach is to force managers and executives to think clearly about your industry’s structure. Starting there they can focus on their own and rivals’ relative positions within the industry. Therefore, they can plan for profit, the end game of competition.

Buyer’s Power

Managers and executives need to understand how buyer’s power works against their profitability. Powerful buyers will force prices down or demand more value in the product. They capture more of the value for themselves in this way. This sounds simple enough for most people. However, it underpins the principles of what industry structure is, and more importantly for multinational companies, what they should do when they sell the same product to different buyer’s bargaining power regions. Consider the case for CEMEX, a Mexican multinational company for building materials and cement. In the United States, big, powerful construction companies account for a large percentage of the cement industry’s sales. They use their clout in bargaining for low prices, thus limits the profit potential for the industry. But when CEMEX sell the same product across the border to Mexico, where close to 80 percent of the cement is purchased by thousands of small, individual customers, we see an industry structure with fragmented buyers and a few large sellers. As a result, CEMEX, a leading producer in both countries, earns higher returns in Mexico, and not because it creates more value in its home market. In effect, CEMEX is competing in two distinct industries , each with its own industry structure. This can be a lesson for executives and decision makers in multinational companies, which is, when deciding whether centralize or de-centralize, they should first assess if there is any significant industry structural difference in place.

power works against their profitability. Powerful buyers will force prices down or demand more value in the product. They capture more of the value for themselves in this way. This sounds simple enough for most people. However, it underpins the principles of what industry structure is, and more importantly for multinational companies, what they should do when they sell the same product to different buyer’s bargaining power regions. Consider the case for CEMEX, a Mexican multinational company for building materials and cement. In the United States, big, powerful construction companies account for a large percentage of the cement industry’s sales. They use their clout in bargaining for low prices, thus limits the profit potential for the industry. But when CEMEX sell the same product across the border to Mexico, where close to 80 percent of the cement is purchased by thousands of small, individual customers, we see an industry structure with fragmented buyers and a few large sellers. As a result, CEMEX, a leading producer in both countries, earns higher returns in Mexico, and not because it creates more value in its home market. In effect, CEMEX is competing in two distinct industries , each with its own industry structure. This can be a lesson for executives and decision makers in multinational companies, which is, when deciding whether centralize or de-centralize, they should first assess if there is any significant industry structural difference in place.

Within an industry there may be segments of buyers with more or less bargaining power, and with greater or lesser price sensitivity. Buyers are more likely to exercise their negotiating leverage if they are price sensitive. Both industrial customers and consumer tend to be more price sensitive when what they’re buying is:

Undifferentiated

Expensive relative to their costs or income

Inconsequential to their own performance

There is a counterexample that includes all three these conditions is the price insensitivity of makers of major motion pictures when they buy or rent production equipment. Let’s say a highly sophisticated camera, which is a highly differentiated piece of equipment. Its price is small relative to the other costs of production, but the performance of the equipment has a big impact on the success of the movie. Here quality supersedes price by leaps and bounds.

Suppliers’s Power

Suppliers are critical for a company’s success, especially in a fast-growing industry. However, if you have powerful suppliers, they will use their negotiating leverage to charge higher prices or to insist on more favorable terms. In either case, industry profitability will be lower because suppliers will capture more of the value for themselves. This spells a grim picture for the PC industry, where makers of personal computers have long struggled with the bargaining power f both Microsoft and Intel. In Intel’s case, the Intel Inside campaign effectively branded what might have otherwise become a commodity component—the CPUs. Intel achieve this by limiting their buyer’s bargaining power with brand awareness directly to the OEM’s consumers. Namely the PC users like you and me. Do you still remember having to ask for the model of CPU before making a purchase decision? This act alone really bypasses the PC makers’ brand influence for some level.

a fast-growing industry. However, if you have powerful suppliers, they will use their negotiating leverage to charge higher prices or to insist on more favorable terms. In either case, industry profitability will be lower because suppliers will capture more of the value for themselves. This spells a grim picture for the PC industry, where makers of personal computers have long struggled with the bargaining power f both Microsoft and Intel. In Intel’s case, the Intel Inside campaign effectively branded what might have otherwise become a commodity component—the CPUs. Intel achieve this by limiting their buyer’s bargaining power with brand awareness directly to the OEM’s consumers. Namely the PC users like you and me. Do you still remember having to ask for the model of CPU before making a purchase decision? This act alone really bypasses the PC makers’ brand influence for some level.